By now you may have heard how much Apple is worth. Heck, there are even stories on what you can actually buy with that mind-boggling amount of money, as if you’d even need indications on how to spend such a cash hoard.

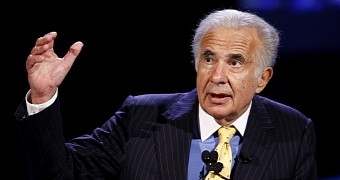

But investor Carl Icahn is unfazed by the news. He not only expected Apple to reach a $700 billion (€618 billion) market valuation, he actually anticipates that figure to nearly double in the future. In a note issued on behalf of his firm, he points out the following to anyone even remotely interested in trading:

“We have gained further confidence in our thesis, increasing the forecasted EPS for FY 2015 in our model from $9.60 [€8.49] to $9.70 [€8.58], and now believe the market should value Apple at $216 [€190] per share. This is why we continue to own approximately 53 million shares worth $6.5 billion, and why we have not sold a single share.”

Like Jon Cramer said earlier this week, in a nutshell, don’t trade Apple, own it.

These people are probably right, too. For one thing, Icahn’s resume alone should tell you that his trading advice is invaluable. Secondly, Apple hardly ever slows down. The Apple Watch is not even out yet, and there are even rumors that it’s going into the automotive business.

Far-fetched? Maybe. But when it comes to the stock market, even feeble rumors can turn you a handsome profit over night.

14 DAY TRIAL //

14 DAY TRIAL //