Owning $4.4 billion (€3.88 billion) in Apple shares, renowned investor Carl Icahn continues to have great faith in the Cupertino-based electronics vendor, and especially so with Tim Cook at its helm.

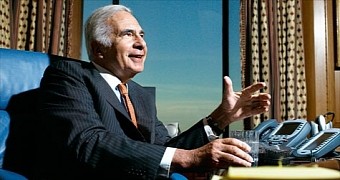

Icahn, who holds a huge position in Apple not only to turn a profit but also to have influence as an investor, strongly believes Apple should do another buyback, but he’s more concerned about the hesitation that some traders may have when it comes to AAPL. To them, he has this to say, in an interview with the CNBC:

“I don’t recommend too many stocks, I don’t like to do that unless I think it’s a no-brainer/ And this one is sort of amazing to me, because you know every decade you get one of these — maybe two or three…. I guess we’re going to have to revise our guidance.”

AAPL rose more than 7 points in Wednesday trading after the technology juggernaut posted the most profitable quarter in the history of any company, reporting an 18$ billion (€15.84 billion) bottom line for the quarter ended in December. The company's market valuation also ballooned as a result of record iPhone sales, as well as strong Mac and iPad sales. In just a few months, the company plans to unveil its all-new Apple Watch.

Icahn and his analysts believe Apple’s share value will soon hit $200 (€176), from the $118 (€103) where it stands today.

14 DAY TRIAL //

14 DAY TRIAL //